Mortgage: Refinance or Modification

The possibility of losing your home because you can’t make the mortgage payments can be terrifying. Perhaps you’re having trouble making ends meet because you or a family member lost a job, or you’re having other financial problems.

Do you know what kind of mortgage you have? Do you know whether your payments are going to increase? If you can’t tell by reading the mortgage documents you received at settlement, contact your loan servicer and ask. Your loan servicer typically processes your loan payments, keeps track of principal and interest you pay, and manages your escrow account if you have one. It can also respond to your inquiries.

If you are having trouble making your payments, contact your loan servicer to discuss your options as early as you can. The longer you wait, the fewer options you will have.

Mortgage Toolbox for Consumers

This toolbox provides a series of questions and answers to help consumers understand the advantages and disadvantages of a mortgage refinance and a mortgage modification, and where they can get more information

-

When is it right to refinance?

Have interest rates fallen? Or do you expect them to go up? Has your credit score improved enough that you might be eligible for a lower-rate mortgage? Would you like to switch to a different type of mortgage?

The answers to these questions will influence your decision to refinance your mortgage. But before deciding, you need to understand all that refinancing involves. When you refinance, you pay off your existing mortgage and create a new one.

Your home may be your most valuable financial asset, so you want to be careful when choosing a lender or broker and specific mortgage terms. Aside from potential benefits to refinancing, there are also costs.

-

Why consider refinancing?

Lower your interest rate

Refinancing may lower your interest rate. The interest rate on your mortgage determines how much you pay on your mortgage each month – lower rates usually mean lower payments. You may be able to get a lower rate because of changes in the market conditions or because your credit score has improved. A lower interest rate may allow you to build equity in your home more quickly.

For example, compare the monthly payments (for principal and interest) on a 30-year fixed-rate loan of $200,000 at 5.5% and 6.0%.

Comparison of monthly payments on a 30-year fixed rate loan at 5.5% and 6.0% Conceptual Point Value Monthly payment @ 6.0% $1,199 Monthly payment @ 5.5% $1,136 The difference each month is $ 63 But over a year's time, the difference adds up to $ 756 Over 10 years, you will have saved $7,560 Increase loan term

Refinancing may increase the term of your mortgage. You may want a mortgage with a longer term to reduce the amount that you pay each month. However, this will also increase the length of time you will make mortgage payments and the total amount that you end up paying toward interest.

Decrease loan term

Refinancing may decrease the term of your mortgage. Shorter-term mortgages – for example, a 15-year mortgage instead of a 30-year mortgage – generally have lower interest rates. Plus, you pay off your loan sooner, further reducing your total interest costs. The trade-off is that your monthly payments usually are higher because you are paying more of the principal each month.

For example, compare the total interest costs for a $200,000 fixed-rate loan at 6% for 30 years vs. 5.5% for 15 years.

Chart showing type of loans versus monthly paymens and total interest paid. Type of loan Monthly payment Total interest 30-year loan @ 6.0% $1,199 $231,640 15-year loan @ 5.5% $1,634 $ 94,120 Change from adjustable-rate to fixed-rate product

If you have an adjustable-rate mortgage, or ARM, your monthly payments will change as the interest rate changes. With this kind of mortgage, your payments could increase or decrease.

You may find yourself uncomfortable with the prospect that your mortgage payments could go up. In this case, you may want to consider switching to a fixed-rate mortgage to give yourself some peace of mind by having a steady interest rate and monthly payment. You also might prefer a fixed-rate mortgage if you think interest rates will be increasing in the future.Get an ARM with better terms

If you currently have an ARM, will the next interest rate adjustment increase your monthly payments substantially? You may choose to refinance to get another ARM with better terms. For example, the new loan may start out at a lower interest rate. Or the new loan may offer smaller annual interest rate adjustments or lower interest rate caps over the life of the loan, which means that the interest rate cannot exceed a certain amount.

For more details, see the Federal Reserve Board’s (FRB) Consumer Handbook on Adjustable-Rate Mortgages (opens new window).

Get cash out from the equity built up in your home

Home equity is the dollar-value difference between the balance you owe on your mortgage and the value of your property. When you refinance for an amount greater than what you owe on your home, you can receive the difference in a cash payment (known as a cash-out refinancing). You might choose to do this, for example, if you need cash to make home improvements or pay for a child’s education.

Remember, though, when you take out equity it will take time to rebuild the equity in your home. This means that if you need to sell your home, it will not put as much money in your pocket after the sale.

If you are considering a cash-out refinancing, think about other alternatives as well. You could shop for a home equity loan or home equity line of credit instead. Compare a home equity loan with a cash-out refinancing to see which is better for you.For more details, see the FRB’s What You Should Know about Home Equity Lines of Credit.

-

When is refinancing a bad idea?

You’ve had your mortgage for a long time

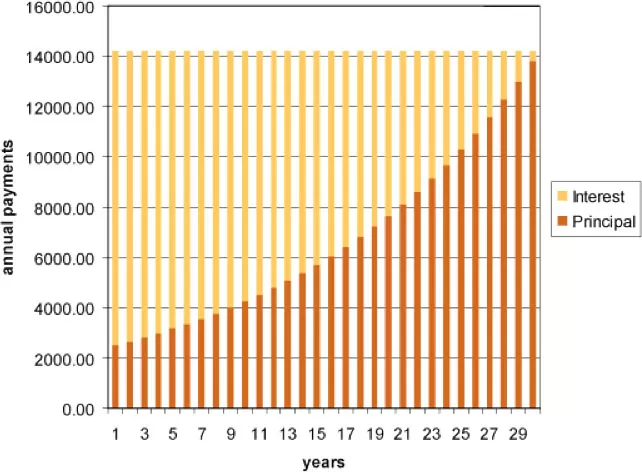

The amortization chart shows that the proportion of your payment that is credited to the principal of your loan increases each year, while the proportion credited to the interest decreases each year. In the later years of your mortgage, more of your payment applies to principal and helps build equity. By refinancing late in your mortgage, you will restart the amortization process, and most of your monthly payment will be credited to paying interest again and not to building equity.

Amortization of a $200,000 loan for 30 years at 5.9% [d]

Your current mortgage has a prepayment penalty

A prepayment penalty is a fee that lenders might charge if you pay off your mortgage loan early, including refinancing. If you are refinancing with the same lender, ask whether the prepayment penalty can be waived. You should carefully consider the costs of any prepayment penalty against the savings you expect to gain from refinancing. Paying a prepayment penalty will increase the time it will take to break even, when you account for the costs of the refinance and the monthly savings you expect to gain.

You plan to move from your home in the next few years

The monthly savings gained from lower monthly payments may not exceed the costs of refinancing. A break-even calculation will help you determine whether it is worthwhile to refinance, if you are planning to move in the near future.

-

What determines eligibility to refinance?

Determining your eligibility for refinancing is similar to the approval process that you went through with your first mortgage. Your lender will consider your income and assets, credit score, other debts, the current value of the property, and the amount you want to borrow. If your credit score has improved, you may be able to get a loan at a lower rate. On the other hand, if your credit score is lower now than when you got your current mortgage, you may have to pay a higher interest rate on a new loan.

Lenders will look at the amount of the loan you request and the current appraised value of your home. If the loan-to-value (LTV) ratio does not fall within their lending guidelines, they may not be willing to make a loan, or may offer you a loan with less-favorable terms than you already have.

If housing prices fall, your home may not be worth as much as you owe on the mortgage. Even if home prices stay the same, if you have a loan that includes negative amortization (when your monthly payment is less than the interest you owe, so all of your payment goes to interest), you may owe more on your mortgage than you originally borrowed. If this is the case, it could be difficult for you to refinance.

-

What will refinancing cost?

It is not unusual to pay 3 percent to 6 percent of your outstanding principal in refinancing fees. These expenses are in addition to any prepayment penalties or other costs for paying off any mortgages you might have.

Refinancing fees vary from state to state and lender to lender. Here are some typical fees you are most likely to pay when refinancing:Application fee. For processing your loan request and obtaining your credit report.

Loan origination fee. Upfront fee to process a loan.

Points. This may be a one-time charge paid to reduce your interest rate, or it could be a charge by the lender or broker to earn money on the loan.

Title search and title insurance. To verify rightful ownership of the property and to check for liens. Title insurance covers the lender against errors in the results of the title search.Inspection fee. For analysis of the structural condition of the home by a property inspector, engineer, or consultant. The lender or your state may require additional inspections, such as for termites or other pests.

Flood hazard fee. To determine whether your property is located in a flood hazard zone and requires flood insurance.

Appraisal fee. To assess the value of your home.

Attorney review/closing fee. For costs associated with closing the loan for the lender.Prepayment penalty. Fee for paying off an existing mortgage early. Loans insured or guaranteed by the federal government generally cannot include a prepayment penalty, and some lenders, such as federal credit unions, cannot charge prepayment penalties.

Other fees may be required for loans insured or guaranteed by federal government housing programs, as well as conventional loans insured by private mortgage insurance.

Your lender will require that you have a homeowner’s insurance policy (sometimes called hazard insurance) in effect at settlement. The policy protects against physical damage to the house by fire, wind, vandalism, and other causes covered by your policy. With refinancing, you may only have to show that you have a policy in effect.

For more information on getting the best mortgage and understanding your closing costs, see the Consumer Financial Protection Bureau’s (CFPB) home loan toolkit step-by-step guide.

-

What is "no-cost" refinancing?

Lenders often define “no-cost” refinancing differently, so be sure to ask about the specific terms offered by each lender. Basically, there are two ways to avoid paying up-front fees.

The first is an arrangement in which the lender covers the closing costs, but charges you a higher interest rate. You will pay this higher rate for the life of the loan. The second is when refinancing fees are included in (“rolled into” or “financed into”) your loan—they become part of the principal you borrow. While you will not be required to pay cash up front, you will instead end up repaying these fees with interest over the life of your loan.

Be sure to ask the lender offering a no-cost loan to explain all the fees and penalties before you agree to these terms.

-

How do you calculate the break-even period?

Use the step-by-step worksheet in this section to give you a ballpark estimate of the time it will take to recover your refinancing costs before you benefit from a lower mortgage rate. The example assumes a $200,000, 30-year fixed-rate mortgage at 5% and a current loan at 6%. The fees for the new loan are $2,500, paid in cash at closing.

Calculating the break-even point Step Example Your numbers 1. Your current monthly mortgage payment $1,199 2. Subtract your new monthly payment - $1,073 3. This equals your monthly savings $ 126 4. Subtract your tax rate from 1

(e.g. 1 - 0.28 = 0.72)0.72 5. Multiply your monthly savings (#3) by your after-tax rate (#4) 126 x 0.72 6. This equals your after-tax savings $ 91 7. Total of your new loan's fees and closing costs $2,500 8. Divide total costs by your monthly after-tax savings (from #6) $2,500 / 91 9. This is the number of months it will take you to recover your refinancing costs 27 months If you plan to stay in the house until you pay off the mortgage, you may also want to look at the total interest you will pay under both the old and new loans.

You may also want to compare the equity build-up in both loans. If you have had your current loan for a while, more of your payment goes to principal, helping you build equity. If your new loan has a term that is longer than the remaining term on your existing mortgage, less of the early payments will go to principal, slowing down the equity build-up in your home.

Refinancing calculators

Many online mortgage calculators are designed to calculate the effect of refinancing your mortgage. These calculators usually require information about your current mortgage (such as the remaining principal, interest rate, and years remaining on your mortgage), the new loan that you are considering (such as principal, interest rate, and term), and the upfront or closing costs that you will pay for the loan.

An online Refinancing Calculator(opens new window) will show the amount you will save compared with the costs you will pay, so that you can determine whether the refinancing offer is right for you.

-

How can you shop for a new loan?

Shopping around for a home loan will help you get the best financing deal. Comparing and negotiating terms could save you hundreds or thousands of dollars. Begin by getting copies of your credit reports to make sure the information in them is accurate (go to the Federal Trade Commission's (opens new window) (FTC) website for information about free copies of your report).

The FTC’s Mortgage Shopping Worksheet may help you compare costs. Take this worksheet with you when you talk with each lender or broker, and fill out the information provided. Don’t be afraid to let them know you are shopping for the best deal.Talk to your current lender

If you plan to refinance, you may want to start with your current lender. That lender may want to keep your business, and may be willing to reduce or eliminate some of the typical refinancing fees. For example, you may be able to save on fees for the title search, inspection, and flood hazard determination. Or your lender may not charge an application fee or origination fee. This is more likely to happen if your current mortgage is only a few years old, so that paperwork relating to that loan is still current. Let your lender know you are shopping around for the best deal.

Compare loans before deciding

Compare all the terms that different lenders offer, particularly interest rates and fees. Lenders are required by federal law to provide a Loan Estimate within three days of receiving your mortgage loan application. The estimate should give you a detailed approximation of all costs involved in closing. Review this document carefully.

Note: When you apply with multiple lenders for comparison, each will pull a credit report, and multiple credit pulls could negatively affect a credit score, especially if you are starting with a lower score.

If you’re shopping for a home equity line of credit, or a loan through certain types of homebuyer assistance programs, you should receive a Truth in Lending disclosure instead.

Get information in writing

Ask for information in writing about each loan you are interested in before you pay a nonrefundable fee. It is important that you read this information and ask the lender or broker about anything you don’t understand.

You may want to talk with financial advisers, housing counselors, other trusted advisers, or an attorney.Use newspapers and the Internet to shop

Your local newspaper and the Internet are good places to start shopping for a loan. You can usually find information on interest rates and points offered by several lenders. Since rates and points can change daily, you’ll want to check information sources often when shopping for a home loan.

Be careful with advertisements

Any initial information you receive about mortgages probably will come from advertisements, mail, phone, and door-to-door solicitations from builders, real estate brokers, mortgage brokers, and lenders. Although this information can be helpful, keep in mind that these are marketing materials – the ads and mailings are designed to make the mortgage look as attractive as possible.

These advertisements may play up low initial interest rates and monthly payments, without emphasizing that those rates and payments could increase substantially later. So get all the facts and make sure any offers you consider meet your financial needs.

Choosing a mortgage may be the most important financial decision you will make. You should get all the information you need to make the right decision. Ask questions about loan features when you talk to lenders, mortgage brokers, settlement or closing agents, and other professionals involved in the transaction – and keep asking until you get clear and complete answers.For more information, visit the CFPB’s mortgage resources on its website.

-

What is a mortgage modification?

Under this option, you reach an agreement with your mortgage company to change the original terms of your mortgage—such as payment amount, length of loan, interest rate, etc. In most cases, when your mortgage is modified, you can reduce your monthly payment to a more affordable amount.

-

When is modifying a good option?

Mortgage loan modification may be a good alternative if you’re ineligible to refinance or you’re facing a long-term hardship. It may also be appropriate if you are several months behind on your mortgage payments, or likely to fall behind soon, and on the verge of losing your house.

-

What are the benefits?

If you’re past due in making your payments, modifying your mortgage will immediately resolve the delinquency status with your mortgage company. It may reduce your monthly payments to a more affordable amount, or permanently change the original terms of your mortgage, giving you a fresh start. Loan modification is less damaging to your credit score (opens new window) than a foreclosure. You can stay in your home and avoid foreclosure.

-

How does it work?

A modification involves one or more of the following: changing the mortgage loan type (for example, from an adjustable rate mortgage to a fixed-rate mortgage); extending the term of the mortgage (for example, from a 30-year term to a 40-year term); reducing the interest rate either temporarily or permanently; adding any past-due amounts, such as interest and escrow, to the unpaid principal balance, which is then re-amortized over the new term.

-

What are the next steps?

Gather your financial information. Contact your mortgage company. Explain your current situation. Your mortgage company wants to help you keep your home and avoid foreclosure. Contact them quickly to see if you are eligible for a modification.

-

What if I receive an offer from another company?

Beware of scams. If you receive an offer, information or advice that sounds too good to be true, it probably is. Scam artists are stealing millions of dollars from distressed homeowners by promising immediate relief from foreclosure, or demanding cash for counseling services when HUD-approved counseling agencies(opens new window) provide the same services for FREE. Don't let them take advantage of you, your situation, your house or your money.

-

Refinance and Modification Resources