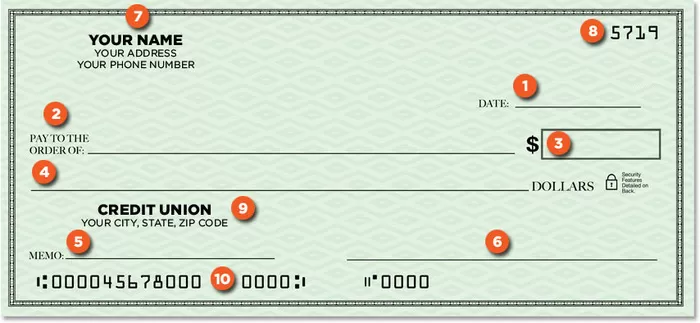

Understanding a Check

Filling Out a Check

To complete your checks, you will need to fill in the following pieces of information:

- The date.

- The Pay to the Order of line.

This is where you write the name of the person or company to whom you will give the check. After writing the name, you can draw a line to the end. This prevents anyone from adding an additional name on your check. - The dollar amount of the check in numbers.

Such as $19.75. - The dollar amount of the check in words.

Such as Nineteen and 75/100. After writing out the amount of the check, draw a line to the end. This prevents anyone from adding an additional amount after what you have written. - The memo section.

This area is optional. You can use this area to remind yourself why you wrote the check or to record the account number of the bill you are paying. - The signature line. Did you know that the line you sign on is actually micro-sized text that forms a line? This is one of many security features on a check.

What is on the Check That You Will Need to Know

- Your name.

Your address and phone number are sometimes included. - The check number.

The number is used to identify each check written. - Your financial institution’s number and branch.

- Routing and Account numbers. These numbers are helpful when setting up direct deposit or an automatic withdrawal/deposit.

What is on The Back of Your Check?

There is also important information printed on the back of your checks:

The back of the check has an endorsement area. Endorsing a check means to sign the back of the check to make it “cashable.” For example, if you write a check to your friend, your friend would endorse the check to get the cash or the deposit the amount into his or her account.

10 Best Practices When Writing a Check

- Always check your balance to make sure you have enough money before writing a check.

- Record the transaction and update the balance after writing a check.

- Write checks legibly with a pen.

- Print the correct date on the check. Do not post-date a check.

- Make sure the number and written words you write for the check amount match.

- Write the check amount to the left of the amount line.

- If you make a mistake on a check, write “VOID” across the check’s face, tear up the check, and write a new one.

- Don’t sign blank checks.

- Use restrictive endorsements, such as “For Deposit Only,” when appropriate.

- Destroy voided or unused checks and deposit slips.

How to Balance Your Checkbook

- Update your balance in your checkbook register by keeping track of each withdrawal and deposit as they occur.

- When you receive your monthly statement from your credit union, balance, or reconcile, the statement to your checkbook register. To reconcile the statements, match each transaction in the statement to the transactions in your register and place a mark next to the transaction in your register for each transaction that matches the statement. If you have a record of a transaction that does not appear on the statement, the transaction may still be pending or may not have been presented to the credit union.

- The balances as of the end of the month should match. If the balances do not match, check your register to see whether one of your withdrawals or deposits has not been processed, the credit union has a record of a transaction that you do not have recorded in your register, or the amount of one of the transactions differs.

- To match your current balance to the balance from the statement, add back to your current balance any withdrawals made after the date of the statement and subtract the amount of any deposits made after the date of the statement. This should match the balance from the statement.

- If the balances still do not match, check your register and receipts against the record from the credit union to determine whether an error has occurred. Also check for any arithmetic errors (e.g., adding rather than subtracting) in your register. If you believe an error has occurred, contact your credit union.