What is a substitute check?

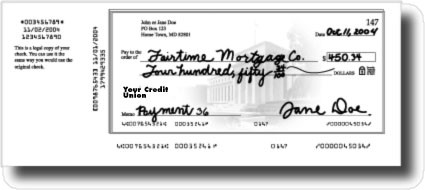

A substitute check is a special paper copy of the front and back of an original check. It may be slightly larger than the original check. Substitute checks are specially formatted so they can be processed as if they were original checks. The front of a substitute check should state: "This is a legal copy of your check. You can use it the same way you would use the original check."

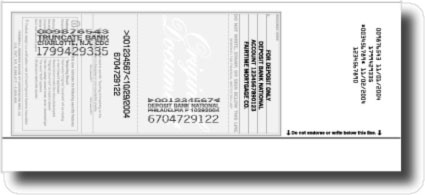

The following sample shows what a substitute check looks like.

Front of a substitute check

Back of a substitute check

Not all copies of a check are substitute checks. For example, pictures of multiple checks printed on a page (also known as an image statement) that is returned to you with your monthly statement are not substitute checks. Online check images and photocopies of original checks are not substitute checks either. You can use image statements and other copies of checks to verify that your financial institution has paid a check.

Why are substitute checks created?

Some financial institutions find that exchanging electronic images of checks with other financial institutions is faster and more efficient than physically transporting paper checks. In certain circumstances, however, financial institutions may need to use a paper check. To address this need, a federal law, known as the Check Clearing for the 21st Century Act (Check 21), allows a financial institution to create and send a substitute check that is made from an electronic image of the original check.

When must my original check be returned?

In general, the law does not require your financial institution to return your original check. Many financial institutions destroy original paper checks. Others may store original checks for some period of time and then destroy them. Check 21 ensures you have the same legal protections when you receive a substitute check from your financial institution as you do when you receive an original check.

What if a substitute check causes an error in my account?

Check 21 provides a special process that allows you to claim a refund (also known as an expedited recredit) when you receive a substitute check from a financial institution and you think there is an error. For example, you may think you were charged twice for the same check.

You may use the special process to get a refund of the money you lost. The amount of your refund under the special process is limited to the amount of your loss or the amount of the substitute check that you received, whichever is less, plus interest on that amount if your account earns interest. If your loss is more than the amount of the substitute check, you may have the right under other laws to recover additional amounts of money.

Your financial institution generally has 10 business days after receiving your claim to complete an investigation and recredit your account for up to $2,500 per check (plus interest if your account earns interest), pending completion of the investigation. Exceptions are made for new accounts, accounts repeatedly overdrawn, and suspicion of fraudulent activity. All funds must be recredited within 45 calendar days after receiving your claim. If your financial institution finds that your claim is not valid, it will send you a notice explaining why.

Your financial institution may reverse the refund (including any interest on the refund) if it can show that the substitute check did not cause an error in your account.

How do I file a claim related to a substitute check?

If you notice a problem with a substitute check, you should contact your financial institution as soon as possible. In general, to use the special refund procedure for substitute checks, you should contact your financial institution no later than 40 days from the date your financial institution provided the substitute check or from the date of the statement that shows the problem.

Describe why you think the charge to your account is incorrect. Explain why you believe the original check or a better version of the substitute check is needed to determine whether the amount should have been deducted from your account. Estimate how much money you lost because of the substitute check. Include any fees you were charged as a result of the substitute check. Also, alert your financial institution to any interest you lost, if your account earns interest. Provide a copy of the substitute check or give your financial institution information that will help it identify the substitute check and investigate your claim.

What if I have more questions?

To learn more about substitute checks, visit the Federal Reserve Board’s Frequently Asked Questions about Check 21.